Nonresidential Construction Spending Decreases 0.5% in April, Says ABC National

From ABC National

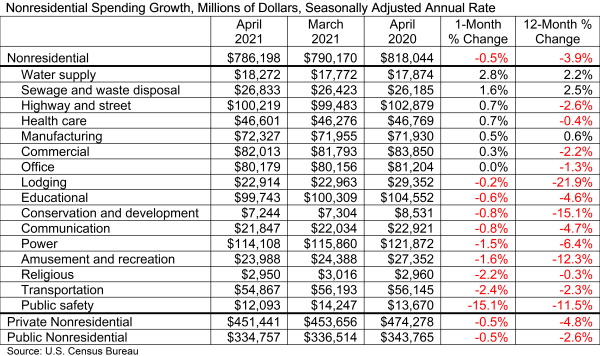

Spending was down on a monthly basis in nine of 16 nonresidential subcategories. Both private and public nonresidential construction spending were down 0.5% for the month.

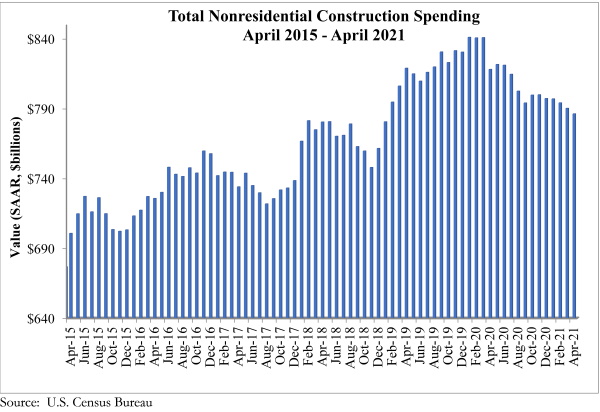

“The fact that nonresidential construction spending continues to decline is no surprise whatsoever,” said ABC Chief Economist Anirban Basu. “Many factors are at work, including the historic lag between broader economic recovery and the onset of persistent recovery in nonresidential construction. In other words, nonresidential spending levels reflect what the broader economy looked like about a year ago. A year ago, the economy was in dire shape.

“There’s more,” said Basu. “Conventional wisdom holds that many of the projects postponed during the earlier stages of the pandemic are set to come back to life. It is for this reason that many contractors have reported rising backlog and growing confidence in the six-month outlook for revenues, staffing levels and profits, according to ABC’s latest Construction Backlog Indicator and Construction Confidence Index. But just when it seemed safe to get back into the water, a new set of challenges has emerged. Among these are input shortages, rapidly rising materials prices and ongoing issues securing sufficiently skilled workers. What all this has done is to suppress the vigor of nonresidential construction’s current recovery by inducing certain project owners to further delay their projects, hoping to ultimately receive more favorable bids.

“As if this were not enough, certain construction segments may have been permanently undermined by the pandemic,” said Basu. “Among these are construction of new office buildings, shopping centers and hotels that cater to business travelers. The good news is that the longer-term outlook remains upbeat given the anticipated strength of the economic recovery to come, particularly if a sensible infrastructure package manages to make its way out of Washington, D.C.”